The 5-Minute Rule for Eb5 Investment Immigration

The 5-Minute Rule for Eb5 Investment Immigration

Blog Article

Top Guidelines Of Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration - An OverviewOur Eb5 Investment Immigration PDFsA Biased View of Eb5 Investment Immigration3 Simple Techniques For Eb5 Investment ImmigrationTop Guidelines Of Eb5 Investment ImmigrationA Biased View of Eb5 Investment ImmigrationEb5 Investment Immigration Fundamentals Explained

The capitalist needs to preserve 10 already existing staff members for a duration of at least 2 years. If a capitalist likes to spend in a regional center firm, it may be better to invest in one that only requires $800,000 in financial investment.Financier requires to reveal that his/her financial investment produces either 10 straight or indirect work. Generally used a placement as a Restricted Obligation Companion, so investor has no control over daily operations. Moreover, the general companions of the local facility firm normally gain from investors' financial investments. To learn more regarding EB-5 visas and Regional Centers, see our EB-5 committed site or call Immigration Solutions LLC..

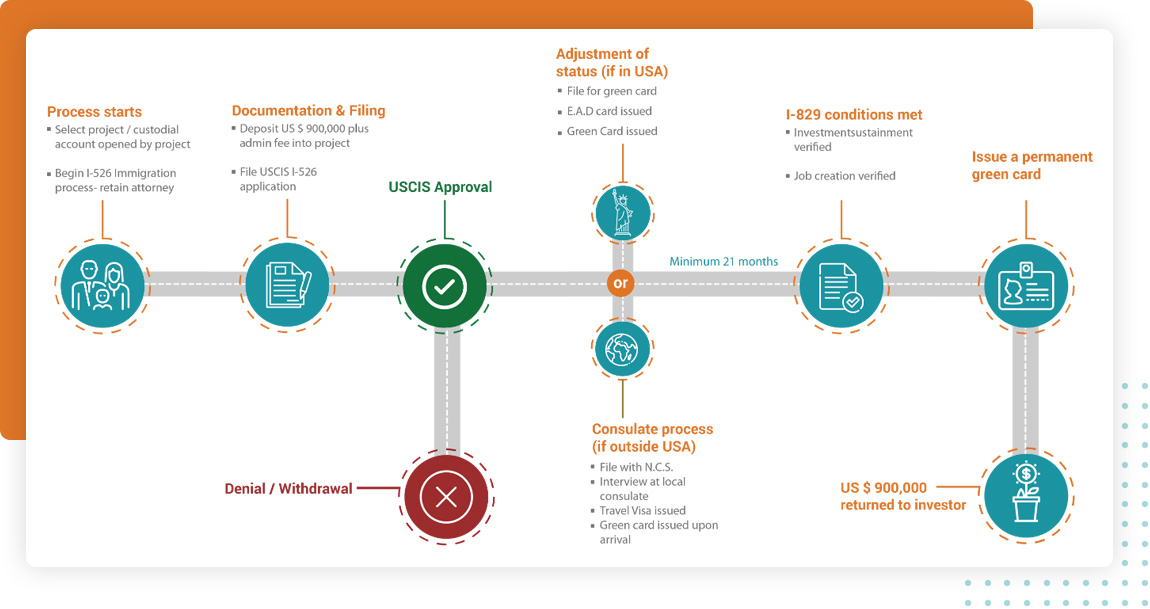

We check your investment and work development development to make sure compliance with EB-5 demands throughout the conditional duration. We aid gather the needed documentation to show that the called for financial investment and job production requirements have actually been met.

One of one of the most vital elements is ensuring that the investment stays "at threat" throughout the procedure. Recognizing what this requires, in addition to financial investment minimums and just how EB-5 financial investments fulfill copyright eligibility, is critical for any kind of possible financier. Under the EB-5 program, financiers should satisfy details funding thresholds. Given that the enactment of the Reform and Honesty Act of 2022 (RIA), the standard minimum investment has been $1,050,000.

Eb5 Investment Immigration Can Be Fun For Everyone

TEAs consist of rural areas or areas with high unemployment, and they incentivize work creation where it's most required. No matter the quantity or classification, the financial investment should be made in a new company (NCE) and produce at the very least 10 full time jobs for United States workers for an EB-5 candidate to receive residency.

Comprehending the "at risk" demand is vital for EB-5 investors. The investment comes with intrinsic risks, cautious task selection and compliance with USCIS standards can assist financiers accomplish their goal: irreversible residency for the financier and their household and the ultimate return of their funding.

The Single Strategy To Use For Eb5 Investment Immigration

To end up being qualified for the visa, you are needed to make a minimal investment depending upon your selected financial investment choice. Two investment alternatives are available: A minimum straight investment of $1.05 million in a united state company beyond the TEA. A minimum financial investment of at the very least $800,000 in a Targeted Work Area (TEA), which is a country or high-unemployment area

Upon approval of your EB5 Visa, you acquire a conditional long-term residency for 2 years. You would certainly need to file a Form I-829 (Petition by Investor to Eliminate Conditions on Permanent Local Condition) within the last 3 months of the 2-year legitimacy to remove the conditions to become an irreversible citizen.

Not known Details About Eb5 Investment Immigration

In an EB-5 regional facility investment, the investor will buy a pre-prepared financial investment structure where the local center has actually established a brand-new business venture. Considering that it's already pre-prepared, the regional facility financial investments need management costs which would certainly set you back $50,000 USD to $70,000 USD. If you're intending to work with an attorney, there may be lower legal fees as contrasted to a direct investment as there is typically ess work.

Nonetheless, according to the EB-5 Reform and Integrity Act of 2022, local facility financiers should also send an additional $1, 000 USD as part of filing their petition. This additional price does not put on a modified demand. If you chose the choice to make a direct financial investment, after that you would certainly require to connect a service strategy together with your I-526.

In a straight financial investment, the investors structure the investment themselves so there's no additional management cost to be paid. Nonetheless, there can be professional costs birthed by the capitalist to ensure conformity with the EB-5 program, such as legal costs, business strategy creating fees, economic expert costs, and third-party reporting costs to name a few.

6 Simple Techniques For Eb5 Investment Immigration

The capitalist is likewise accountable for acquiring a company plan that conforms with the EB-5 Visa needs. This additional price might vary from $2,500 to $10,000 USD, depending upon the nature and framework of the company - EB5 Investment Immigration. There can be extra costs, if it would certainly be sustained, as an example, by marketing research

An EB5 investor must likewise take into consideration tax obligation considerations for the duration of the EB-5 program: Considering that you'll become a permanent local, you will certainly undergo revenue tax obligations on your around the world earnings. Moreover, you must report and pay tax obligations on any income obtained from your financial investment. If you offer your investment, you may go through a resources gains tax.

When you have actually ended up being an U.S. resident and you've acquired buildings along the road, your estate may go through an inheritance tax once you have actually died. You may be also based on local and state tax obligations, besides federal tax obligations, depending upon where you live. An application for an EB5 Visa can get pricey as you'll need to think concerning the minimal investment quantity and the climbing application charges.

10 Easy Facts About Eb5 Investment Immigration Explained

The U.S. Citizenship and Migration Service (USCIS) EB-5 Immigrant Investor Program is carried out by the U.S. Citizenship and Migration Services and is governed by federal regulations and regulations. The EB-5 visa program enables professional financiers to come to be eligible for permits on their own and their reliant member of the family. To qualify, individuals need to spend $1 million in a brand-new company that develops 10 work.

The areas beyond urbane statistical areas that qualify as TEAs in Maryland are: Caroline Area, Dorchester County, Garrett Area, Kent Area and Talbot Area. The Maryland Department of Business is the assigned authority to license areas that certify as high unemployment locations in Maryland based on 204.6(i). Business licenses geographical areas such as counties, Census designated places or census systems in non-rural regions as locations of high unemployment if they have unemployment rates of a minimum of 150 percent of the nationwide unemployment rate.

Getting My Eb5 Investment Immigration To Work

We assess application demands to certify TEAs under the EB-5 Immigrant Investor Visa program. Requests will be reviewed on a case-by-case basis and letters will certainly be issued for locations that fulfill the TEA needs. Please evaluate the steps below to figure out if your recommended project remains in a TEA and important link adhere to the instructions for requesting a certification letter.

Report this page